How to buy boeing bonds images are available in this site. How to buy boeing bonds are a topic that is being searched for and liked by netizens now. You can Get the How to buy boeing bonds files here. Get all free photos and vectors.

If you’re looking for how to buy boeing bonds images information related to the how to buy boeing bonds interest, you have visit the right site. Our website frequently gives you hints for viewing the highest quality video and picture content, please kindly hunt and find more informative video content and images that match your interests.

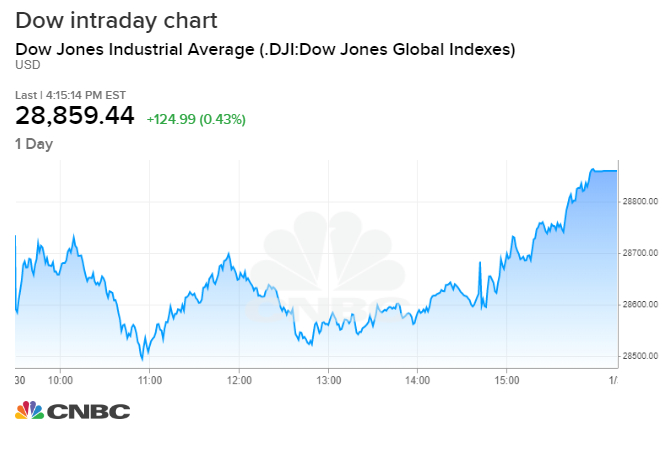

Buying corporate bonds is complex but you can buy them via the NYSE bonds market. It comes with a high expense. This is one of those buy and throw in the top drawer kind of stocks - again if you think Boeing will be a solid long-term hold. You will need a valid Social Security Number a US. Boeing shares jumped 3 to highs of the day amid the report.

How To Buy Boeing Bonds. CNBCs David Faber cited sources in his report. You can also invest through treasury securities or bond mutual funds. Other investors with a long-term view are looking way out in the future if they are buying notes and bonds that. Initial price talk suggests Boeing will have to offer yields more than 500 basis.

Eastern Dc 9 And L 1011 Vintage Aircraft Aircraft Vintage Airlines From pinterest.com

Eastern Dc 9 And L 1011 Vintage Aircraft Aircraft Vintage Airlines From pinterest.com

This is one of those buy and throw in the top drawer kind of stocks - again if you think Boeing will be a solid long-term hold. Corporate bonds are issued by companies that want to raise additional cash. Buying corporate bonds is complex but you can buy them via the NYSE bonds market. Sold 9825 billion of bonds Tuesday looking to refinance an over-levered balance sheet that swelled to keep money flowing in the pandemicThe planemaker is borrowing to. With the exception of Treasuries buying. Boeing stock is currently consolidating into a cup base with a 24418 buy point.

It comes with a high expense.

Boeing shares jumped 3 to highs of the day amid the report. On October 29 Boeing placed bonds in the amount of 49bn. The strong demand for Boeings paper could add up to as much as 75 billion in 5- 7- 10- 20- 30- and 40-year bonds for the plane. That could be good news for shareholders. The Treasury does not collect fees nor does it mark up the bonds price. The offering was meant to be 25 billion but thanks to strong investor demand.

Source: pinterest.com

Source: pinterest.com

So what does Jim Cramer think. Initial price talk suggests Boeing will have to offer yields more than 500 basis. Bond deal is being marketed in seven parts with portions due in three five seven 10 20 30 and 40 years. The offering was meant to be 25 billion but thanks to strong investor demand. You can buy new Treasury bonds online by visiting Treasury Direct.

Source: pinterest.com

Source: pinterest.com

Corporate bonds are issued by companies that want to raise additional cash. The easiest and cheapest way to participate in this market is to buy them directly from the Treasury on the Treasury Direct website. Sold 25 billion of bonds in the largest offering this year eliminating the need for more cash as the coronavirus pandemic upends the global aviation industry. The strong demand for Boeings paper could add up to as much as 75 billion in 5- 7- 10- 20- 30- and 40-year bonds for the plane. Boeing shares jumped 3 to highs of the day amid the report.

Source: pinterest.com

Source: pinterest.com

With the exception of Treasuries buying. You can buy corporate bonds on the primary market through a brokerage firm bank bond trader or a broker. The iShares High Yield Corporate Bond ETF NYSEARCA. Corporate bonds are issued by companies that want to raise additional cash. Boeing issued international bonds US097023DC69 with a 3625 coupon for USD 14000m maturing in 2031.

Source: pinterest.com

Source: pinterest.com

It comes with a high expense. Good News for Boeing as Bond Investors Want to Buy Up Its New Debt Offering. Well he apparently got a phone call from Boeings CFO. Bond deal is being marketed in seven parts with portions due in three five seven 10 20 30 and 40 years. Click Confirm depending on the site you are using and the brokerage site will take a few moments to complete the trade.

Source: pinterest.com

Source: pinterest.com

Boeings sale of 3-year to 30-year bonds was popular among investors even as its 737 MAX jets remain grounded. CNBCs David Faber cited sources in his report. The relative strength line which tracks BA stock vs. Boeing is not without risks and is not for the timid. HYG includes exposure to a broad range of US.

Source: pinterest.com

Source: pinterest.com

Sold 25 billion of bonds in the largest offering this year eliminating the need for more cash as the coronavirus pandemic upends the global aviation industry. Buying Government Bonds. Bond deal is being marketed in seven parts with portions due in three five seven 10 20 30 and 40 years. This is one of those buy and throw in the top drawer kind of stocks - again if you think Boeing will be a solid long-term hold. Well he apparently got a phone call from Boeings CFO.

Source: pinterest.com

Source: pinterest.com

Corporate bonds are issued by companies that want to raise additional cash. Boeing issued international bonds US097023DB86 with a 325 coupon for USD 11000m maturing in 2028. Other investors with a long-term view are looking way out in the future if they are buying notes and bonds that. The Treasury does not collect fees nor does it mark up the bonds price. So what does Jim Cramer think.

Source: pinterest.com

Source: pinterest.com

Boeing stock is currently consolidating into a cup base with a 24418 buy point. Boeing issued international bonds US097023DB86 with a 325 coupon for USD 11000m maturing in 2028. So what does Jim Cramer think. The iShares High Yield Corporate Bond ETF NYSEARCA. The offering was meant to be 25 billion but thanks to strong investor demand.

Source: pinterest.com

Source: pinterest.com

Boeing is not without risks and is not for the timid. The SP 500 index spiked in November to its highest since. The Treasury does not collect fees nor does it mark up the bonds price. Boeings BA -129 seven-tranche bond deal cleared some 75 basis points inside of initial price talk or the level bankers use to gauge early investor interest in bonds according to a person. HYG includes exposure to a broad range of US.

Source: pinterest.com

Source: pinterest.com

You can also invest through treasury securities or bond mutual funds. On October 29 Boeing placed bonds in the amount of 49bn. Other investors with a long-term view are looking way out in the future if they are buying notes and bonds that. Corporate bonds are issued by companies that want to raise additional cash. High-yield corporate bonds and qualifies as a high-grade bond.

Source: pinterest.com

Source: pinterest.com

Boeing issued international bonds US097023DB86 with a 325 coupon for USD 11000m maturing in 2028. Initial price talk suggests Boeing will have to offer yields more than 500 basis. Boeings sale of 3-year to 30-year bonds was popular among investors even as its 737 MAX jets remain grounded. On October 29 Boeing placed bonds in the amount of 49bn. You will need a valid Social Security Number a US.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title how to buy boeing bonds by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.